Navigating the Tire Industry's Changing Landscape: An In-depth Analysis

Jul 19, 2023

There's no denying that the retail tire industry has experienced some rough patches lately, with decreased traffic in tire shops and a general decline in tire replacements for passenger vehicles. But it’s not all doom and gloom, as Torqata Data & Analytics - a key player and data subsidiary of American Tire Distributors Inc. (ATD) - outlines a road map for the industry and predicts potential upturns in sales.

The State of the Tire Market

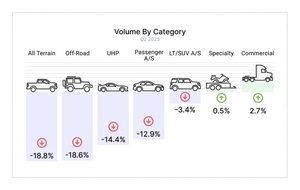

Torqata’s analytics reveal a significant drop in recreational vehicle tire sales (including off-road and all-terrain), a trend that seems to be accelerating. Retail profitability has also taken a hit, despite increased tire prices last year. Tires bought at higher prices in 2022 and stored in inventory are now struggling to sell at reduced retail prices due to a recent dip in wholesale costs. This has resulted in a squeeze on profit margins, especially for passenger and light truck tires.

Understanding the Megatrends

Torqata CEO Tim Eisenmann believes that understanding the current trends and economic disruptions is crucial. He points out a significant trend: visits to tire stores have dipped by 5.5% as of the end of June, compared to the same period last year. This indicates a wider shift in consumer behavior as they cut back on tire shop visits and delay tire replacements.

Interestingly, Torqata has observed a 20% increase in customers buying just one, two, or three tires instead of a full set, signaling consumers' intent to minimize overall spending. Despite these challenging trends, Eisenmann remains optimistic about the future of the industry.

Brand Loyalty and Independent Shops

Tier 1 brands, such as Michelin, have managed to maintain a loyal customer base, with 10% to 20% of tire customers repeatedly choosing a Tier 1 tire for their second and third tire replacements on their vehicles. Meanwhile, independent shops are beginning to adapt to new trends by thinking ahead about servicing electric vehicles and focusing on advanced diagnostics.

Eisenmann doesn't view car dealerships as a significant threat to independent tire shops, arguing that tires tend to be more of an afterthought for dealership service departments.

The Road Ahead

Despite the current challenges, there's a silver lining: tire manufacturers appear bullish for the rest of the year, based on the U.S. Tire Manufacturers Association's shipment forecast. Eisenmann echoes this optimism, predicting an upswing in retail tire sales that could result in ending the year flat compared to the previous year.

He does note that retailer profitability and sales in the coming year will largely depend on several macroeconomic factors, such as the national economy, the ongoing war in Ukraine, and gas prices. Yet, he remains "cautiously optimistic."

Making the Most of the Tire Market

According to Eisenmann, retailers have untapped opportunities for improving profitability. He believes that retailers are leaving money on the table due to suboptimal pricing, incorrect inventory management, and not engaging fully with manufacturer programs.

His advice to retailers? Don’t try to do it all yourself. Instead, partner with manufacturers, distributors, and software vendors to take on some of these tasks. Eisenmann believes that strategic collaboration could potentially increase profits by 20% to 40% for most retailers - without even selling an additional tire.

In conclusion, Eisenmann’s insights provide a detailed snapshot of the tire industry's current landscape and its future prospects. With the right strategies in place, tire retailers can navigate this uncertain terrain and drive towards profitability.